Trends in Real Estate Values in the USA

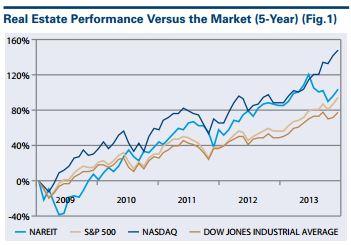

NAREIT IS AN EXCELLENT WAY TO SEE REAL ESTATE TRENDS AND THE CHART GIVES A GOOD VIEW FROM 2009 TO THE BEGINNING OF 2014.

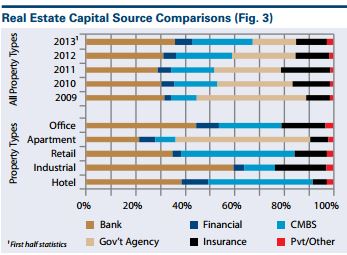

Now if we look at capital sources, (below) we see that banks are increasing their share of new loans for capital, but Commercial Mortgage Backed Securities and Government Agencies are close behind. Insurance companies were gaining on banks in 2011, and private investors in 2013 and 2014 are still growing.

But the facts are that banks , especially in office, hotel and industrial sectors have greatly increased their lending. This is somewhat amazing, when just 2 years ago many wondered which ones of the big boys including CitiBank, Chase, Wells Fargo, and BOA would fail. It would seem that the huge loans that our government made from taxpayer funds, to save the banks (a very liberal idea) that took place during the Bush Administration, went a long way to saving the giant banks of America.

The next item to consider is the cost of money. Cap rates continue to decline and we are seeing national average of cap rates as follows:

- Multifamily (Urban) 5.76%

- Suburban Multifamily 5.87%

- Regional Mall 7.01%

- Community Retail 7.26%

- CBD Office 7.37%

- Neighborhood Retail 7.41%

- Industrial 7.50%

- Suburban Office 7.68%

- Flex Industrial 8.01%

- CBD Office Class B 8.01%

- Community Retail "B" 7.72%

- Suburban Office "B" 8.23%

- Lodging, Full Service 8.31%

- Lodging Limited Svc 8.96%

In general cap rates declined .21% to .28% from 2012 to 2013 and these trends appear to be continuing in 2014.

Bank Discount Rates, or "yields" can be a good indicator of cap rates, and as the spread rises, and the discount rate rises, it may mean that cap rates for that asset will rise. Based on this, we see that some of these property types at some point in the future, cap rates may bottom out at some time in the future. Bank Discount Rates or "yields" (depending upon the bank, location and quality of borrower) range from 1 point to 2 points above cap rates.

We gleaned this information from public sources, published sources, appraisal and real estate companies, newspaper and reporting, as well as other appraisal companies, including Integra Realty Resources, Inc., CRE Finance Council, and Compendium of Statistics from agencies.